estate tax changes effective date

TurboTax Has A Variety Of Solutions And Tools To Help You Meet Your Tax Needs. However the proposal seeks to accelerate the 50 reduction as of year-end.

Music Licensing Contract Free Printable Documents Music Licensing Photography License Agreement

Thus beginning on January 1 2022 the estate and gift tax exemption would decrease to 5 million per taxpayer adjusted annually for inflation since 2011 or.

. The increase was set to expire on December 31 2025. The bill would reduce the current federal estate and gift tax exemptions of 117 million per person to 35 million for transfers at death and 1 million for lifetime gifts. Now here we are in 2021.

The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted effective January 1 2022 instead of. Date of Enactment Changes. Taxation of appreciation at death or at the time of gifts carryover basis enacted in 1976 repealed in 1980 and enacted again in 2001 effective only for 2010.

The proposed effective date of the Treasury proposal is for estates where the decedent dies after December 31 2021. So individual estates in 2022 worth more than 1306 million will pay a marginal estate tax rate of 40 unless existing tax laws change. Potential for the estate exemption to go down to 5M indexed for inflation on January 1 2022.

Even after the sunset of the 2017 tax law changes in 2026 the rate remains at 40. However the proposed effective date for almost everything else described in this. The Tax Bill proposes to reduce the gift estate and generation-skipping transfer tax exemption amounts from 117 million to 5 million adjusted for inflation effective Jan.

The Treasury Budget suggests this tax could be used as a credit against the estate tax. While any proposed changes to tax and estate law probably wont pass through Congress or go into effect until 2022 new laws could be retroactive to January of 2021 or make current estate planning vehicles obsolete as of January 1. Expansion of credits Child EITC Child Dependent Care TC.

List of the estate and gift tax proposals gives the date each proposal was eventually enacted in some form. Meanwhile it is no secret that the net worths of the wealthy have continued to grow exponentially. Effective Date This provision is effective for tax years beginning January 1 2022.

The proposed effective date for changes in the gift and estate tax exemptions and tax rates is January 1 2022. January 1 2022 EstateGift Tax Exemption Cut in Half Currently the gift estate and GST tax exemptions are each 117 million per person for 2021. Forcing a mark-to-market deemed sale and realization of any built-in capital gains.

Taxable estates get hit with 40 of their taxable assets above 1 million. However the change to the top capital gains rate which is increased to 25 is effective beginning after September. 1 2022 which would mean an exemption of approximately 6 million.

Effective Dates of Estate and Gift Tax Changes in the House Bill. The effective dates of the newly enacted provisions generally are expected to be Jan. Other changes are set to be effective for transactions occurring on or after September 13 2021 including a 25 capital gains rate and having the sales of Section 1202 company stock also known.

Under the 2017 Tax Cuts and Jobs Act the federal gift estate and generation-skipping transfer tax exemption was temporarily doubled to 10 million adjusted for inflation 117 million in 2021. With more wealth and substantially less estate planning attorneys skilled in advanced estate tax planning those who maintained their advanced estate planning practices have prospered like never before. EstateGift Tax Exemption Cut in Half Effective January 1 2022 - Use It or Lose It.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. President-elect Bidens tax plan as published on October 26 2020 indicates that a Biden administration would seek to revert the gift estate and GST tax provisions to what they were in 2009. Proposed Changes The proposal would impose a 3 surcharge tax on the gross income in excess of 100000 for a trust or estate 2500000 for a married individual filing a separate return and 5000000 for any other taxpayer.

That is the gift tax exemption was 1 million and the estate tax. The increased exemption amount is due to sunset by its own terms on December 31. Yet for those farms in which the tax is applicable estate taxes can still be burdensome.

The lifetime exemption was increased from 55-million to 11-million with adjustments for inflation as part of the 2017 Tax Act. Lifetime estate and gift tax exemptions reduced and decoupled. Under current law this exemption is planned to sunset to 5 million adjusted for inflation on January 1 2026.

Unification of the gift and estate taxes. The changes would be effective beginning after December 31 2021. Get Your Max Refund Today.

The effective date of these tax rates and the tax bracket is January 1 2022. 1 2022 but certain provisions may have proposed effective dates tied to the date of announcement committee action or enactment. As of today the estate and gift tax exemption is scheduled to return to one-half of the current value as of January 1 2026.

Bpcl Dividend History Dividend Investing Dividend Income Investing

Types Of Financial Statements Financial Statement Financial Documents Financial

Tehelka Tv Promo News 01 Film Song Tv New Art

What Happened To The Expected Year End Estate Tax Changes

Oil Change Log Printable Oil Change Vehicle Maintenance Log Car Maintenance

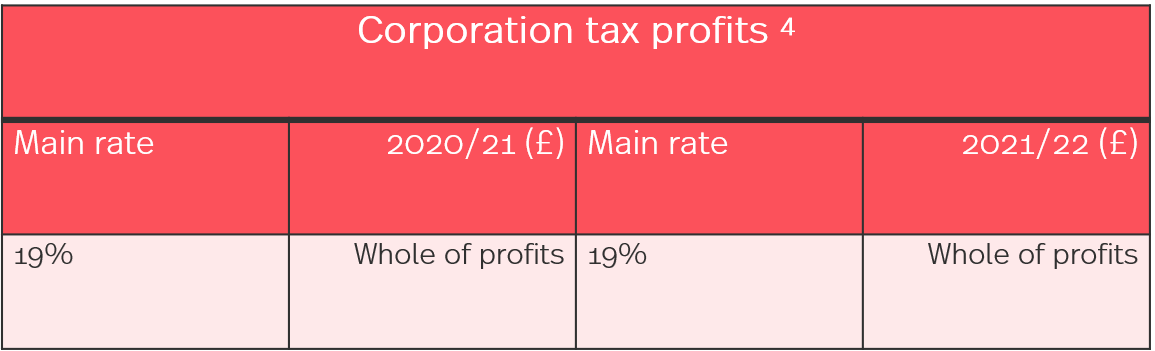

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Guide Your International Clients Who Work And Live Both Inside And Outside Of The Us The Continuing Education Credits Business Format American Bar Association

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Pin On Craft Biz Bookkeeping Tips Yarnybookkeeper Com

Top 7 Digital Transformation Trends In Financial Services For 2019 Digital Transformation Financial Services Financial

Tax And National Insurance Contribution Rates Low Incomes Tax Reform Group

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

How Do You Buy A Car That Belonged To A Deceased Person Are The Rules That May Differ From A Will And Testament Funny Selfie Quotes Last Will And Testament

The Seller Lead Sheet How Real Estate Agents Use One Real Estate Agent Marketing Real Estate Real Estate Agent

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Pin By Tina On Irs In 2022 Irs Taxes Capital Gains Tax Tax Brackets

Should You Elect The Alternate Valuation Date For Estate Tax

3 Day Closing Disclosure Rule Calendar Graphics Calendar Examples How To Find Out Calendar